The degree of operating leverage can show you the impact of operating leverage on the firm’s earnings before interest and taxes (EBIT). Also, the DOL is important if you want to assess the effect of fixed costs and variable costs of the core operations of your business. By calculating the DOL, you can understand how fixed costs influence your business profitability.

Understanding Operating Leverage

As a result, we can calculate the DOL using the company’s contribution margin, which is the difference between total sales and variable sales. The higher the degree of operating leverage (DOL), the more sensitive a company’s earnings before interest and taxes (EBIT) are to changes in sales, assuming all other variables remain constant. The DOL ratio helps analysts determine what the impact of any change in sales will be on the company’s earnings. Understanding the financial health and risk factors of a company is essential for investors, business owners, and financial analysts. The Degree of Operating Leverage (DOL) is a crucial financial metric that helps assess a company’s sensitivity to changes in its operating income. It is particularly useful for gauging the potential impact of cost changes on the company’s profitability.

Operating Leverage Formula

The Excel degree of operating leverage calculator is available for download below. The calculator is used to calculate the DOL by entering details relating to the quantity of units sold, the unit selling price and cost price, and the fixed costs of the business. Use this calculator to easily determine the Degree of Operating Leverage (DOL) for your business. Simply input the values for sales, fixed costs, and variable costs to get the result.

Support Pricing Decisions

A company with low operating leverage has a large proportion of variable costs—which means that it earns a smaller profit on each sale, but does not have to increase sales as much to cover its lower fixed costs. A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs. This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales. When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs. Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability. Managers use operating leverage to calculate a firm’s breakeven point and estimate the effectiveness of pricing structure.

The calculator produces the income statement of the business based on the quantity of units entered in Step 2. The benefit that results from this type of cost structure is that, if sales increase, the company’s profits will also increase correspondingly. Fixed costs do not vary with the volume of sales, whereas variable costs vary directly with sales volume.

Secondly enter the quantity of units sold, unit selling price and unit cost price information for each business. The degree of operating leverage calculator works out the contribution margin per unit sold. Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue.

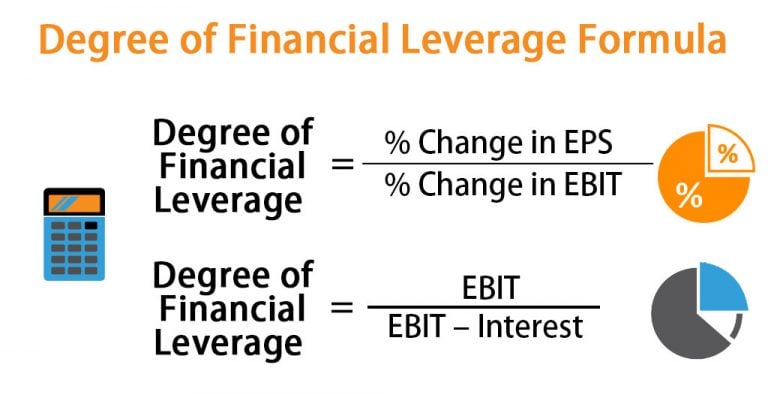

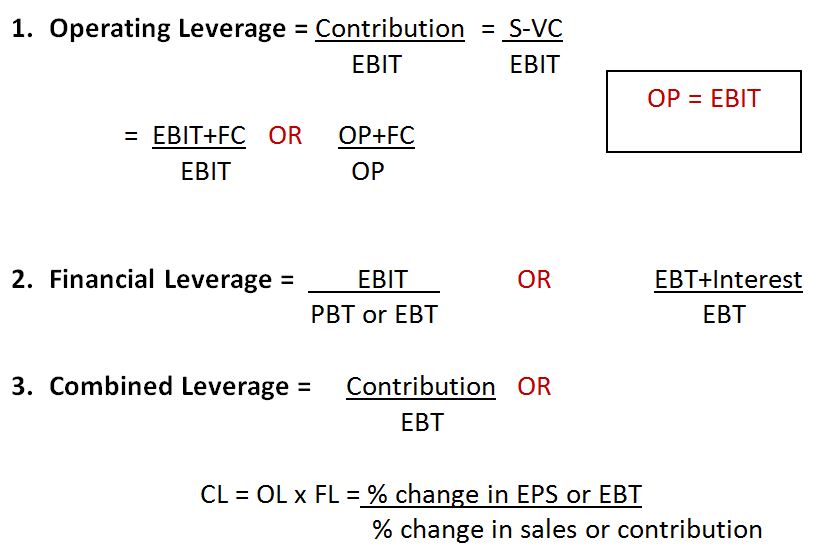

This ratio summarizes the effects of combining financial and operating leverage, and what effect this combination, or variations of this combination, has on the corporation’s earnings. Not all corporations use both operating and financial leverage, but this formula can be used if they do. A firm with a relatively high level of combined leverage is seen as riskier than a firm with less combined leverage because high leverage means more fixed costs to the firm. In fact, operating leverage occurs when a firm has fixed costs that need to be met regardless of the change in sales volume. The operating leverage formula is used to calculate a company’s break-even point and help set appropriate selling prices to cover all costs and generate a profit. This can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits.

- In the final section, we’ll go through an example projection of a company with a high fixed cost structure and calculate the DOL using the 1st formula from earlier.

- To lower your DOL, consider reducing fixed costs, increasing variable costs, or adjusting your cost structure to make it more flexible in response to sales changes.

- This calculator simplifies the DOL calculation, facilitating a better understanding of financial leverage and operational efficiency for businesses, financial analysts, and students.

- Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage.

- Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range.

- Understanding the financial health and risk factors of a company is essential for investors, business owners, and financial analysts.

A higher DOL suggests that any price changes will have a magnified effect on your profits. Determine the optimal pricing strategy by considering the DOL and its implications. This variation of one time backward inhibitory learning in honeybees or six-time (the above example) is known as degree of operating leverage (DOL). Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.