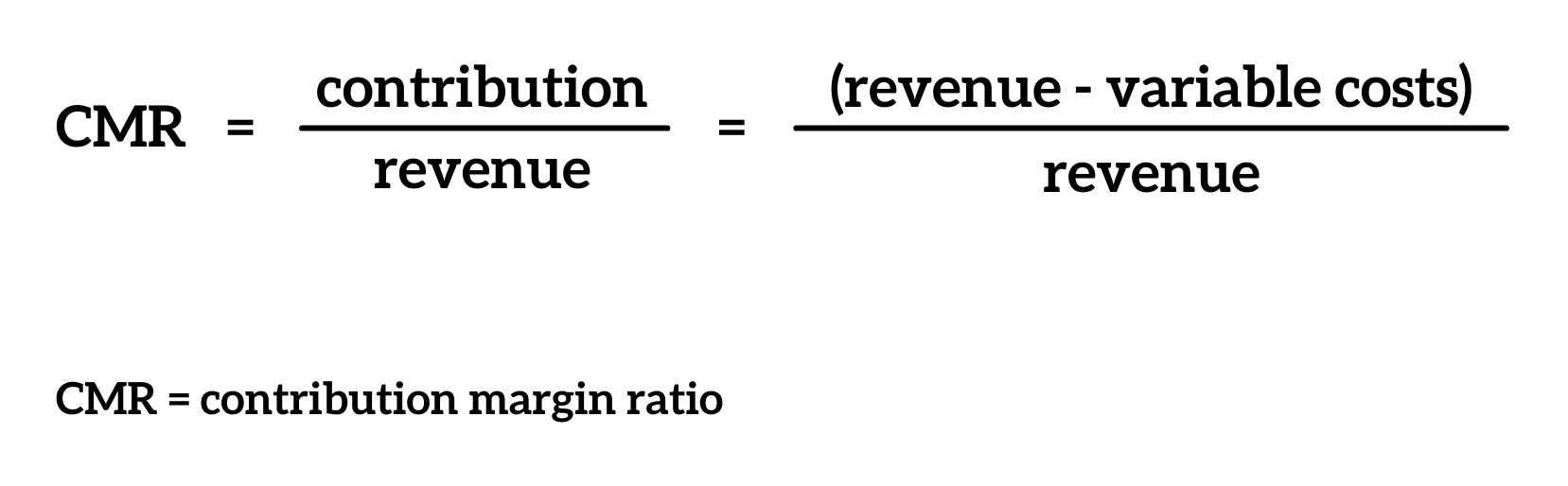

Thus, 20% of each sales dollar represents the variable cost of the item and 80% of the sales dollar is margin. Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. At a contribution margin ratio of \(80\%\), approximately \(\$0.80\) of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit. The contribution margin ratio for the birdbath implies that, for every \(\$1\) generated by the sale of a Blue Jay Model, they have \(\$0.80\) that contributes to fixed costs and profit. Thus, \(20\%\) of each sales dollar represents the variable cost of the item and \(80\%\) of the sales dollar is margin.

Total Cost

A high contribution margin indicates that a company tends to bring in more money than it spends. Alternatively, the company can also try finding ways to improve revenues. However, this strategy could ultimately backfire, and the power of collaboration with the xero ecosystem hurt profits if customers are unwilling to pay the higher price. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

How do you calculate the contribution margin ratio?

In the Dobson Books Company example, the contribution margin for selling $200,000 worth of books was $120,000. Variable Costs depend on the amount of production that your business generates. Accordingly, these costs increase with the increase in the level of your production and vice-versa. This means the higher the contribution, the more is the increase in profit or reduction of loss. In other words, your contribution margin increases with the sale of each of your products.

The Contribution Margin Income Statement: Everything You Need to Know

Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. Furthermore, this ratio is also useful in determining the pricing of your products and the impact on profits due to change in sales.

Second, variable selling and administrative expenses are grouped with variable production costs, so that they are part of the calculation of the contribution margin. And finally, the gross margin is replaced in the statement by the contribution margin. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output.

- Discover books, articles, webinars, and more to grow your finance career and skills.

- To work out the contribution margin, you need to understand the difference between an item’s fixed and variable expenses.

- By tracking changes in contribution margins alongside key performance indicators, businesses can quickly identify trends, spot emerging challenges, and capitalize on opportunities.

- It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

- Parties concerned with the financial aspects of the business may be more likely to understand break-even in dollars; someone interested in operations may be more concerned with break-even in units.

A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

These sophisticated tools streamline data aggregation and analysis, allowing finance teams to effortlessly consolidate contributions from various business segments. With all relevant information at their fingertips, finance professionals can conduct robust analyses and make informed decisions that drive financial optimization. In this article, we shall discuss two main differences of two income statements – the difference of format and the difference of usage. The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68.

If a company uses the latest technology, such as online ordering and delivery, this may help the company attract a new type of customer or create loyalty with longstanding customers. In addition, although fixed costs are riskier because they exist regardless of the sales level, once those fixed costs are met, profits grow. All of these new trends result in changes in the composition of fixed and variable costs for a company and it is this composition that helps determine a company’s profit. The difference between fixed and variable costs has to do with their correlation to the production levels of a company. As we said earlier, variable costs have a direct relationship with production levels.

Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows. The electricity expenses of using ovens for baking a packet of bread turns out to be $1. There are a few different types of contribution margin formulas you might want to use. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues. It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage.