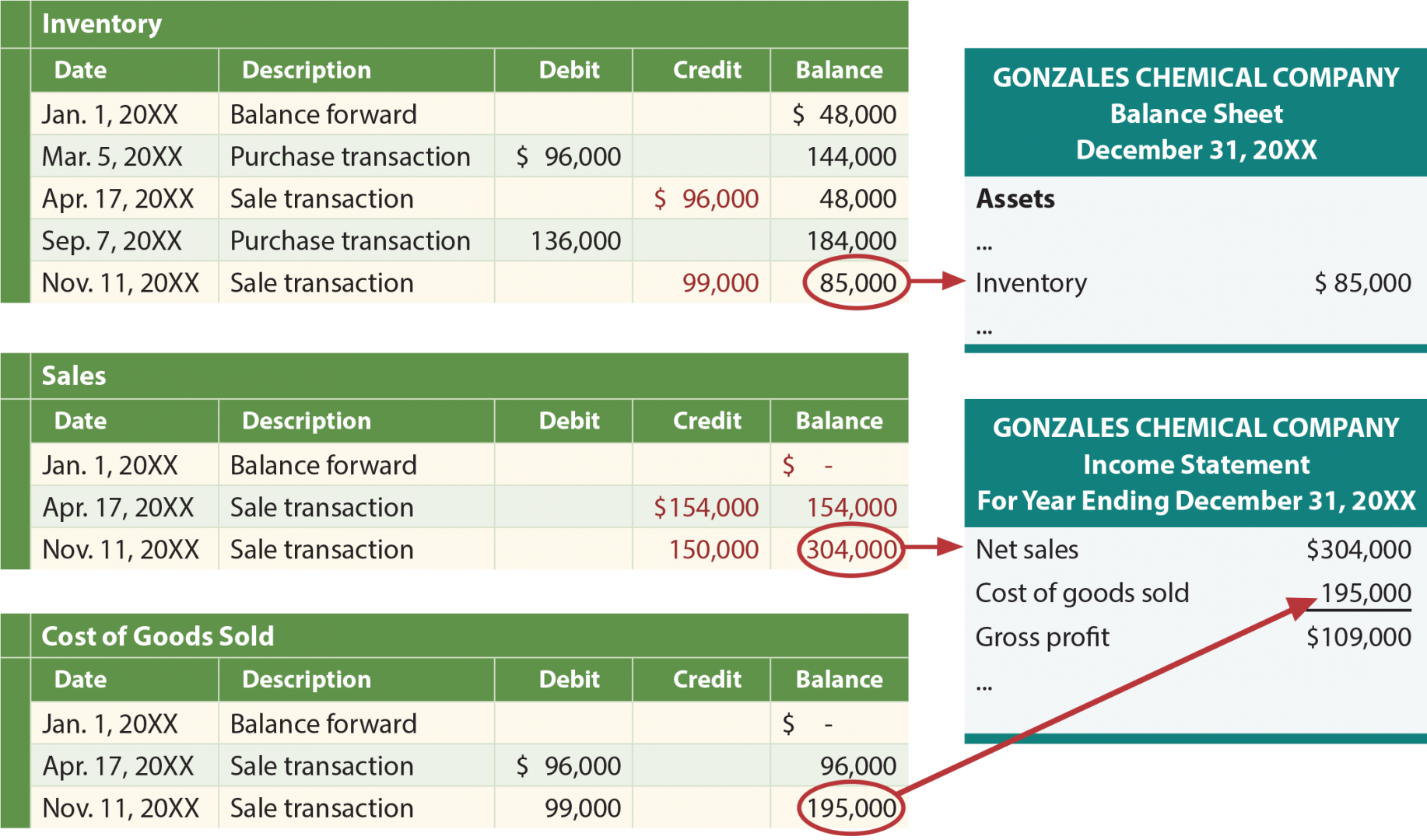

The automatic, or perpetual, updating of the inventory is what gives the system its name and differentiates it from the periodic approach. The following cost of goods sold, inventory, and gross margin were determined from the previously-stated data, particular to perpetual, LIFO costing. When using the perpetual inventory system, the general ledger account Inventory is constantly (or perpetually) changing.

Inventory and Cost of Goods Sold Outline

Moreover, the impact of LIFO on financial statements extends to cash flow considerations. Since LIFO often results in higher COGS and lower taxable income, companies may benefit from lower tax liabilities, thereby improving cash flow. This aspect can be particularly advantageous in times of inflation, allowing businesses to reinvest saved funds into operations or growth initiatives. However, it is essential to weigh this benefit against potential drawbacks, such as the risk of eroding shareholder value due to perceived lower profitability.

Which financial ratios does LIFO ending inventory calculation affect?

- If the inventory units sold during a day are equal or less than the inventory units purchased during the same day, we will assign that day’s cost to the inventory sold because it is the most recent purchase cost.

- Note that this $21 is different than the gross profit of $20 under periodic LIFO.

- This means that the goods sitting in the ending inventory are the earliest purchases.

- Under the last-in, first-out assumption, we always remove goods sold from the most recent purchase.

Let’s say on January 1st of the new year, Lee wants to calculate the cost of goods sold in the previous year. If Ava needs to raise the product cost to make more profit or lower the cost to make it more competitive in the marketplace, she now knows how it will affect her company’s bottom line. Economic Order Quantity (EOQ) considers how much it costs to store the goods alongside the actual cost of the goods.

Periodic Inventory System:

The results dictate the optimal amount of inventory to buy or make to minimise expenses. This system depends on proper inventory control procedures.For example, the system needs to ensure that employees scan in any new inventory promptly. Physical counts to reconcile the database are rare, but necessary, since the true inventory count can become skewed over time with theft, loss or breakage. Below are some of the most frequently asked questions about using a perpetual inventory system. This section will discuss some of the most common situations where implementing a perpetual inventory system can be highly beneficial.

Tax Implications

However, the system requires consistent record-keeping and monitoring and is more expensive to set up than other methods. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. After the January 10 sale, we still have 150 units from the second layer and it is enough to cover the January 15 sale of 120 units. As of January 15, we still have 30 units from beginning inventory and 30 units from the January 5 purchase.

It allows them to record lower taxable income at times when higher prices are putting stress on their operations. The perpetual inventory system keeps track of inventory balances continuously. This is done through computerized systems using point-of-sale (POS) and enterprise asset management technology that record inventory purchases and sales. It is far more sophisticated than the periodic system of inventory management. A perpetual inventory system allows for quick identification and resolution of issues such as stock discrepancies or data entry errors.

Let’s explore the LIFO method and discover if this is the best fit for your inventory needs. You can learn about other methods of tracking inventory costs in our guide to cost of goods sold (COGS). Conversely, in a period of decreasing prices, the reverse accounting examples of long would be true. In a periodic LIFO system, inventory records are only updated at the end of a reporting period. To calculate the cost of sales, we need to deduct the value of ending inventory calculated above from the total amount of purchases.

Companies debit their inventory account with the cost of the merchandise each time they purchase or produce inventory and when they sell inventory to customers. The perpetual inventory software updates the inventory account with each transaction. With each sale, the software also updates the COGS account with a debit.

So, Lee decides to use the LIFO method, which means he will use the price it cost him to buy lamps in December. To calculate the Cost of Goods Sold (COGS) using the LIFO method, determine the cost of your most recent inventory. FIFO, or First In, First Out, is an inventory valuation method that assumes that inventory bought first is disposed of first. Please note how increasing/decreasing inventory prices through time can affect the inventory value.

Perpetual inventory methods are increasingly being used in warehouses and the retail industry. With perpetual inventory, overstatements, also called phantom inventory, and missing inventory understatements can be kept to a minimum. Perpetual inventory is also a requirement for companies that use a material requirement planning (MRP) system for production. Let’s compute the ending inventory step by step using the sample data taken from the inventory records of a company selling table tennis paddles. Figure 10.14 shows the gross margin, resulting from the specific identification perpetual cost allocations of $7,260. FIFO is more common, however, because it’s an internationally-approved accounting methos and businesses generally want to sell oldest inventory first before bringing in new stock.